42 gift card sales tax

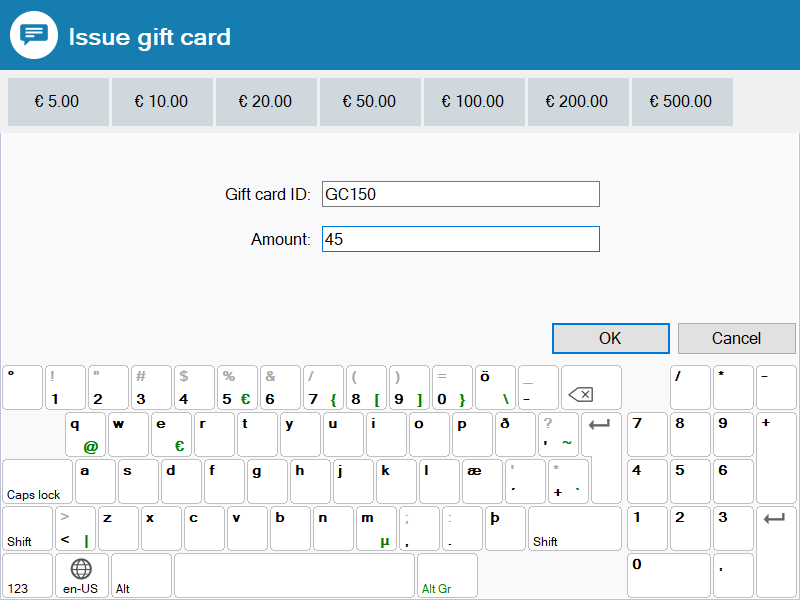

Sales Tax on Gift card sales - Microsoft Dynamics Community Search for Commerce parameters/Tab Posting/section Gift card: - Gift card product= 9999. - Tax on gift cards= YES. - Gift card company= USRT. - Journal= GenJrn. 3. Set up Item sales tax group on Gift card item: Search for Released products by category/find Gift card item 9999/Edit/Tab Sell/section Taxation: - Item sales tax group= RP. Playing Your Cards Right: Can You Defer Taxes on Gift Card Sales? - ORBA To determine whether deferring gift card income is a worthwhile strategy, it is important to weigh the potential tax benefits against the cost of tracking gift card activity. Unless your gift card sales are large enough that deferral will generate significant tax savings, you may be better off simply including these sales in taxable income when received and avoiding the expense of a sophisticated tracking system.

Gift Card Taxes - Shopify Community Charging tax on the gift card and continuing to charge tax on your products would effectively be double-charging customers sales tax, since the gift card is simply a payment method. That being said, there are some European countries that require merchants to charge VAT when single-use vouchers are purchased.

Gift card sales tax

IRS Confirms the Sale of Gift Cards Is Immediately Taxable IRS Confirms the Sale of Gift Cards Is Immediately Taxable Client Alerts/Reports March 2009 The Internal Revenue Service recently confirmed its position that income from the sale of gift cards is taxable in the year of receipt for a gift card issuer that uses the accrual method of accounting. 2021-2022 Gift Tax Rate: What Is It? Who Pays? - NerdWallet How the gift tax is calculated and how the annual gift tax exclusion works. In 2021, you can give up to $15,000 to someone in a year and generally not have to deal with the IRS about it. In 2022 ... Tax treatment of gift cards - Henry+Horne For example, if the typical combined federal, state, and local income tax rate is 30%, add that to the Medicare and Social Security rate of 7.65%, and the gift card should be $160.38 (recording it as $160.38 of supplemental income, and withholding $60.38).

Gift card sales tax. Gift Cards | Federal Trade Commission These rules apply to two types of cards: Retail gift cards, which can only be redeemed at the retailers and restaurants that sell them; and bank gift cards, which carry the logo of a payment card network like American Express or Visa and can be used wherever the brand is accepted. The FTC has brought enforcement actions against several ... Gift Cards and Gift Certificates Statutes and Legislation Relates to exemptions from sales and use taxes for gift certificates, electronic gift cards and magnetic gift cards. ... and limits the purchase pawn, receipt, sale or exchange of a gift card with a pawnbroker. Wisconsin A.B. 761 Failed to pass pursuant to Senate Joint Resolution 1 4/13/16. Wyoming H.B. 95 Signed by governor 3/4/16, Chapter 73 When buying gift cards, make sure you aren't charged sales tax. If you plan to buy gift cards to give away as gifts (or even to purchase something for yourself), make sure the cashier doesn't try to charge you sales tax on the purchase of the card. The sales tax on the monetary value of the gift card is charged when the recipient ultimately uses the card to make purchases, therefore no state in the U.S. requires retailers to charge sales taxes on the purchase of gift cards. Gift Card Accounting, Part 2: The Rules for Tax - Firm of the Future This means that on the 2017 tax return, they will recognize these amounts from their sales of gift cards: Cards sold in 2017 and redeemed in 2017 = $12,459. Cards sold in 2016 and redeemed in 2017 = $1,289. Cards sold in 2015 and redeemed in 2017 = $76.

How Sales Tax Applies to Discounts, Coupons & Promotions The state of Texas offers the following example of how it applies sales tax to this type of promotion: A retailer advertises pants as "buy one, get one free.". The first pair of pants is priced at $120; the second pair of pants is free. Tax is due on $120. Having advertised that the second pair is free, the store cannot ring up each pair of ... Deferral of Income From Sales of Gift Cards - The Tax Adviser On July 24, 2013, the IRS issued Rev. Proc. 2013-29, which allows taxpayers to defer income from the sale of gift cards or gift certificates redeemable by an unrelated entity until the cards or certificates are redeemed for goods and services by that entity. This modification is effective for tax years ending on or after Dec. 31, 2010. Do you pay sales tax on gift cards? - CardCash Blog No. Gift cards are not taxable. The purchase that you buy using that gift card will be taxed, so if tax is paid on a gift card they will be paying twice. Unfortunately, a lot of unsuspecting customers do pay tax on a gift card purchase. Sales tax should only be charged when using the gift card, never when buying it. Retail gift cards and store credits - a tax and unclaimed property ... The proper income tax treatment of gift card sales as an advance payment; The use of special-purpose subsidiaries to issue retail gift cards; The bulk sale of gift cards to third-party vendors; and

IRS Issues Guidance on Treatment of Gift Cards - The Tax Adviser An eligible gift card sale is. the sale of a gift card (or gift certificate) if: (1) the taxpayer is primarily liable to the customer (or holder of the gift card) for the value of the card until redemption or expiration, and (2) the gift card is redeemable by the taxpayer or by any other entity that is legally obligated to the taxpayer to accept the gift card from a customer as payment for items listed in Sections 4.01(3)(a)-(j) of this revenue procedure. Should I tax customers for gift cards? - Avalara At the time, neither you nor the purchaser knows where and how the recipient will use the card. For example, the recipient could use a $100 card for 50 $2 purchases or put it toward one $200 purchase. The recipient could use the card in California or Maine, at your location or at one in a jurisdiction that charges a higher local sales tax. Gift cards, gift certificates, and layaway purchases Taxes do not apply to gift cards and gift certificates at the time of sale. Businesses who issue gift cards and gift certificates should report income when the customer redeems the card or certificate. If sales tax applies to the sale, then the seller should collect retail sales tax at the time of redemption. Retailers must be mindful of gift card tax pitfalls Under the right circumstances, retailers have a limited ability to defer the recognition of income for federal income tax purposes for the sale of gift cards (including issuing refunds on a gift card) from the year of sale into the subsequent tax year. In December 2017, Congress amended section 451 of the Internal Revenue Code.

Sales Tax and Gift Certificates - AccurateTax.com It may be all the same to your shop, however, states that do charge tax have thought up ways to get around this. For example in 2012, New York State legislators tried to pass a law that changed the sales tax from the time of usage to the time of purchases - passing the sales tax onto the gift card buyer rather than the giftee. No vote was ever taken on this law; however, you can imagine the accounting nightmare if such a law was passed in a only few states!

PDF New IRS Advice on Taxability of Gift Cards Treatment of ... - IRS tax forms employer provides gift cards, certificates, or coupons to purchase a turkey, ham, or other nominal value property, these are considered wages and are subject to income and employment taxes (even when the card restricts the items purchased, the time to use the coupon, and any unused

How to Record Gift Cards: Ecommerce Accounting & Bookkeeping - Amaka When a gift card is actually redeemed, we can then recognise a sales transaction. We can now CR the sales account, usually a revenue account, as well as CR the tax account, assuming you're in a region where tax is recorded only once a gift card is used. This reduces the liability account for gift cards as the amount has been fulfilled.

Accounting for Gift Card Sales - Withum According to a First Data 2018 Prepaid Consumer Insights Study, the average consumer spends $59 beyond the original value of gift cards, with supermarket gift cards averaging an astounding 94 percent above the original denomination. The most popular categories are fine dining, fast casual eateries and drugstores.

Are Gift Cards Taxable? | Taxation, Examples, & More - Patriot Software Step 1: Add up all the tax rates that apply to the gift card Let's say your business is in a state without state or local income taxes. Add together the tax rates of 22% (federal income tax), 6.2% (Social Security tax), and 1.45% (Medicare tax). 22% + 6.2% + 1.45% = 29.65% Step 2: Turn the total tax rate into a decimal

Itunes Gift Card Sales Tax? - Spacetime Studios When you purchase a Gift Card you cannot be taxed on it. (So if its $50, you pay $50.) The reason you are not taxed on it is because it is like-cash value. However, when you make purchases using that card, your purchases would be taxed according to local laws. Depending on your country or state etc, the rules are different.

Treatment of Gift Card/Certificate Sales: No Answers, More Questions For example, certain federal income tax issues arise with the use of gift card managing subsidiaries (gift card companies, described in more detail below) to sell gift cards and also with the sale of cross-redeemable gift cards. The IRS announced that it plans to focus more on this area.

Gift Tax | Internal Revenue Service - IRS tax forms The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return. The tax applies whether or not the donor intends the transfer to be a gift. The gift tax applies to the transfer by gift of any type of property.

Gift cards and sales tax: How not to get duped - CSMonitor.com A gift card kiosk in New York. Shoppers who have been charged sales tax when buying gift cards or gift certificates, which should be tax-free, should return to the store with their receipt and ask ...

The gift of complexity: Recognizing gift card revenue for tax purposes ... However, for federal income tax purposes, revenue is generally recognized when it's earned, due, or collected —whichever comes first; this means that revenue from gift card sales is recognized in taxable income when the gift card is sold rather than when it's redeemed.

How to Handle Gift Cards in Your Accounting | ScaleFactor In fact, many customers who use gift cards will spend 38% more than the funds on their gift card . Benefits of Gift Cards Gift cards provide an influx of cash for your business while increasing your marketing opportunities.

Tax treatment of gift cards - Henry+Horne For example, if the typical combined federal, state, and local income tax rate is 30%, add that to the Medicare and Social Security rate of 7.65%, and the gift card should be $160.38 (recording it as $160.38 of supplemental income, and withholding $60.38).

2021-2022 Gift Tax Rate: What Is It? Who Pays? - NerdWallet How the gift tax is calculated and how the annual gift tax exclusion works. In 2021, you can give up to $15,000 to someone in a year and generally not have to deal with the IRS about it. In 2022 ...

IRS Confirms the Sale of Gift Cards Is Immediately Taxable IRS Confirms the Sale of Gift Cards Is Immediately Taxable Client Alerts/Reports March 2009 The Internal Revenue Service recently confirmed its position that income from the sale of gift cards is taxable in the year of receipt for a gift card issuer that uses the accrual method of accounting.

0 Response to "42 gift card sales tax"

Post a Comment