38 gift card for employees taxable

Are Employee Gifts Taxable? Everything You Need To Know Gift certificates, gift cards and cash equivalent benefits are never tax-exempt This is something the IRS is very clear about. Even if they are given out as holiday or birthday presents from an employer to an employee, these types of gifts are never considered de minimis fringe benefits, and are thus liable to taxation. Are gift cards taxable? | Kroger Gift Cards Yes, gift cards are taxable when received when given to an employee from an employer. Employees will have to claim any funds received on gift cards from their employer in their tax return. Employers will also have to pay tax on any gift cards they give to employees. The IRS will expect tax to be paid on gift cards, even in values as low as $5.

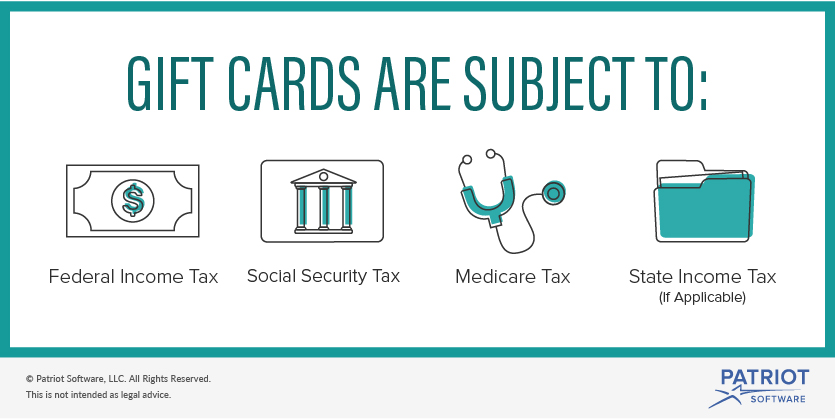

Gifts to Employees - Taxable Income or Nontaxable Gift? All cash or gift cards redeemable for cash are taxable to the employee, even when given as a holiday gift. Monetary prizes, including achievement awards, as well as non-monetary bonuses like vacation trips awarded for meeting sales goals, are taxable compensation - not just for income taxes, but also for FICA. Withholding applies.

Gift card for employees taxable

Are Gift Cards Taxable? | Workest - zenefits.com Employee earns $15 per hour, 40 hours per week: base wages $600. 25% tax rate ($125) take-home pay is $450. If the employer offers a $100 gift card, base wages increase to $700 per week. 25% tax rate ($175) take-home pay is $425 (plus the $100 gift card). An additional $25 on the gift card offsets the paycheck cash loss. Are Gift Cards Taxable Income to Employees? - LinkedIn If you give your employee a VISA gift card to purchase a holiday ham, it is income to the employee, subject to payroll and income taxes! Get More Help IRS Publication 15-B "Employer's Tax Guide To ... Tax free gifts to employees | The Association of Taxation Technicians Whilst everyone enjoys receiving presents at Christmas, employees are unlikely to appreciate gifts from their employer with a tax charge attached. Fortunately, a statutory exemption from income tax and national insurance for employees and employers exists thanks to the trivial benefit rules. The current form of these rules took effect from 6 April 2016, and the key conditions

Gift card for employees taxable. Gifts, awards, and long-service awards - Canada.ca A gift or an award that you give an employee is a taxable benefit from employment, whether it is cash, near-cash, or non-cash. However, we have an administrative policy that exempts non-cash gifts and awards in some cases. Cash and near-cash gifts or awards are always a taxable benefit for the employee. What Employee Gifts Are Taxable? - Gift Me Your Time Are employee gift cards taxable? There is a tax on gift cards. The IRS considers gift cards for employees to be cash equivalents. You have to include gift cards in an employee's income even if it's not much. See also 10 Best Gifts For 32 Year Old Are Christmas gifts to employees taxable? Allowance in Salary - What are Allowance? - Taxable & Non ... Allowance to Government Employees: Any amount paid as a provision for rendering services outside India by the Government Employees is exempt. Allowances to Judges of Supreme Court or High Court are not taxable. Benefits received by the people working in United Nations Organisation (UNO) are fully exempt. Are Gift Cards Taxable to Employees? - Eide Bailly Are Gift Cards Taxable? Gift cards given to employees count as taxable income and must be reported on Form W-2. However, people often incorrectly assume that IRS rules on gift cards to employees are also covered under de minimis fringe benefit rules. What Are De Minimis Fringe Benefits?

De Minimis Fringe Benefits | Internal Revenue Service - IRS tax forms Cash or cash equivalent items provided by the employer are never excludable from income. An exception applies for occasional meal money or transportation fare to allow an employee to work beyond normal hours. Gift certificates that are redeemable for general merchandise or have a cash equivalent value are not de minimis benefits and are taxable. Are Gift Cards For Employees Considered Tax-deductible? Are gift cards taxed? • Employees need to report gift cards and gift certificates as taxable income since these are used in the same way as money. While the expense of the gift card is completely payable by the company, you must pay tax from the worker's compensation for all these incentives. Are Gifts to Employees Taxable? - SST Accountants & Consultants But if the employer gave a gift card to a grocery store for the employee to purchase a turkey, the value of the gift card would be taxable because it is a cash equivalent. For more information, please refer to IRS Publication 5137, Fringe Benefit Guide , or contact the experts at SST for additional assistance. Are Gift Cards Taxable? | Taxation, Examples, & More Aug 02, 2022 · Follow these steps to determine how much to withhold from the gift card for taxes: First, multiply the gift card value by 22% to find the federal income tax: $100 X 0.22 = $22.00. Now, multiply the gift card value by 6.2% to find the Social Security tax (unless the employee has reached the Social Security wage base): $100 X 0.062 = $6.20

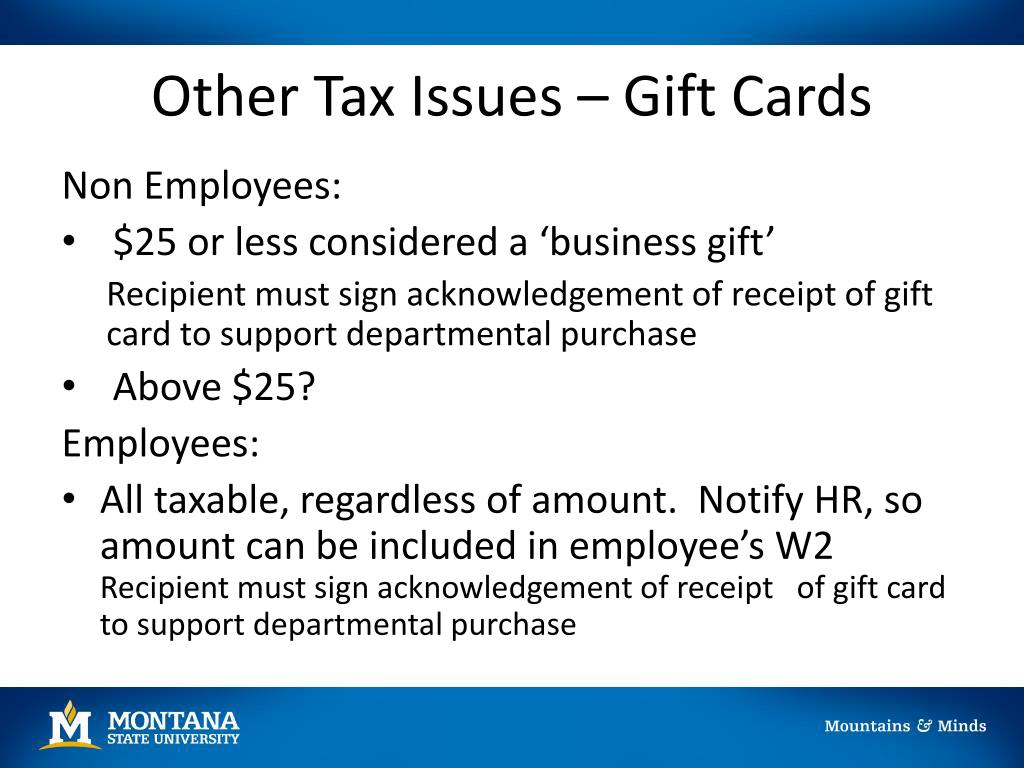

Can I give my employee a gift card without being taxed? There used to be a threshold of $25 to be the maximum amount that could be gifted before having to be taxed, but that is no longer the case. A gift card or cash equivalent is now taxable, regardless of the amount. No matter the amount, a gift card given to employees is not considered a de minimis fringe benefit. PDF New IRS Advice on Taxability of Gift Cards Treatment of ... - IRS tax forms and any unused portion is forfeited). However, Federal tax law does not view giving an employee a turkey or a ham as the equivalent of giving an employee a gift card to purchase a turkey or a ham. A recently issued Tax Advice Memorandum (TAM) in 2004 clarifies the tax law and discusses this issue. Can An Employer Give A Gift Card To An Employee? If you insist on giving gift cards, make sure your workers are aware of the tax implications. According to Jason Fell of Entrepreneur Magazine, the Internal Revenue Service taxes gift cards, even if they are just $5. This implies you'll have to record the gift card's worth as supplemental wages on a W-2 and deduct taxes from the employee's salary. Using gift cards as a tax-free trivial benefit | Blackhawk ... New baby – many employees won’t know if they’re expecting a boy or a girl, therefore the ability to choose what gift card they want will bring new-baby-shopping-pleasure to new parents; GIFT CARD STORE FOR BUSINESS. An easy way to purchase trivial benefit gifts in bulk is using Gift Card Store for Business. You simply log on, select the ...

Are Employee Gift Cards Considered Taxable Benefits? - Strategic HR According to the IRS, cash, gift certificates, and gift cards are considered taxable fringe benefits and must be reported as wages. But you may be relieved to know that this rule doesn't apply to all gifts or perks that you may give to employees. The IRS tells us that we can exclude the value of a "de minimis" benefit from an employee's wages.

Know the tax rules for gifts to employees and customers - Beliveau Law So if you give an employee a $10 Starbucks gift card as a thank-you for working late, the $10 is considered taxable. Stock options are also taxable, and can be subject to complex rules. It's a good idea to explain these rules to employees who may be receiving options for the first time, since it's possible for employees to make big mistakes ...

Are gift cards taxable employee benefits? | PeopleKeep Yes, gift cards are taxable when offered to employees. The IRS considers it as cash-equivalent, meaning you must report the card's value on an employee's Form W-2 just like a wage. This is the same as taxable fringe benefits such as employee stipends, which must also be reported as wages on employees' W-2s.

How To Deduct Employee Gifts, Awards, and Bonuses Aug 22, 2022 · Taxable to Employees . Service and safety awards are not taxable to employees if they are limited. There are limits on service awards (not during the first five years, and not more often than every five years) and safety awards (not to more than 10% of employees). Awards over the limits are taxable to the employee.

Gift from employer, exceeding Rs5,000, is taxable and ... - mint Jan 15, 2018 · Any gift received from the employer, of a sum exceeding Rs5,000, is treated as taxable compensation in your hands [as per Section 17(2)(viii) of the Income Tax Act, 1961 read with Rule 3(7)(iv) of ...

Ask the Expert: Are All Gift Cards Taxable Income? - HR Daily Advisor However, section (c) (1) of this law provides that employee gifts (including prizes and awards) - specifically "any amount transferred by or for an employer to, or for the benefit of, an employee" - may not be excluded from gross income. So the general rule is that employee gifts and prizes are counted as income.

Gift Cards for Your Employees: What You Need to Know - Indeed Gift card values should be recorded as part of employee wages on a W-2 form, included under the boxes for wages, tips and compensation, for Social Security wages, and for Medicare wages and tips. The total quantity of fringe benefits awarded to employees can be reported under "other" on the same W-2 form. Taxes on gift cards outside the U.S.

Must-Know Tax Rules for Employee Gift Cards: 2022 Update - Giftogram In fact, any gift card you award to a customer or prospect is non-taxable, whether it's a just-because gift, a customer incentive, a loyalty reward, or a prize won through a promotional contest. Tax Rules for Gift Cards to Employees Gift cards to employees are always taxable, but following the rules doesn't have to be time-consuming or complicated.

Do gift cards count as taxable income? - Business Management Daily A. The gift cards are taxable compensation to the employees. If the employer pays the employees' portion of the taxes, that payment also represents income to the employees and is taxable to the ...

Tax Rules of Employee Gifts and Company Parties - FindLaw As a general rule, an employer can't really give you a "gift" under the tax code. With only a couple of exceptions, the IRS considers anything your employer gives you to be taxable compensation for your services. Why? There's a simple reason for it.

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages - SHRM Here are the tax rules employers should know if they are planning on thanking their employees with gifts, prizes or a party this holiday season. Reminder: Holiday Gifts, Prizes or Parties Can Be...

Understanding the Taxability of Employee Non-Cash Awards and Gifts The Federal Tax Cuts and Jobs Act (P.L. 115-97) signed into law on December 22, 2017 changed the taxability of some non-cash awards and other gifts provided to employees. If an award or gift (or portion of an award or gift) is taxable, applicable income tax withholding and FICA taxes will be deducted from the employee's paycheck.. Beginning on April 1, 2018, departments are responsible for ...

What Employers Should Know about Giving Gifts to Employees Employer-provided cash or cash equivalent items are taxable. Per the IRS, a gift card is considered a cash equivalent unless it "allows an employee to receive a specific item of personal property that is minimal in value, provided infrequently, and is administratively impractical to account for." [2] Employee Achievement Awards

HS207 Non taxable payments or benefits for employees (2019) If you earn at a rate of less than £8,500 a year and you’re not a director, a gift to mark a personal occasion, such as a wedding present, which is not a reward of your employment, is not taxable.

Employer Guide: What Employee Compensation Is Taxable? Feb 28, 2020 · You may have heard that if you give a gift card under $25 to an employee it's not taxable. That's not true. The IRS says that cash and cash equivalents (gift cards or gift certificates or the use of a charge card, for example) no matter how small, are never considered de minimis, and these payments are taxable to the employee.

Tax free gifts to employees | The Association of Taxation Technicians Whilst everyone enjoys receiving presents at Christmas, employees are unlikely to appreciate gifts from their employer with a tax charge attached. Fortunately, a statutory exemption from income tax and national insurance for employees and employers exists thanks to the trivial benefit rules. The current form of these rules took effect from 6 April 2016, and the key conditions

Are Gift Cards Taxable Income to Employees? - LinkedIn If you give your employee a VISA gift card to purchase a holiday ham, it is income to the employee, subject to payroll and income taxes! Get More Help IRS Publication 15-B "Employer's Tax Guide To ...

Are Gift Cards Taxable? | Workest - zenefits.com Employee earns $15 per hour, 40 hours per week: base wages $600. 25% tax rate ($125) take-home pay is $450. If the employer offers a $100 gift card, base wages increase to $700 per week. 25% tax rate ($175) take-home pay is $425 (plus the $100 gift card). An additional $25 on the gift card offsets the paycheck cash loss.

0 Response to "38 gift card for employees taxable"

Post a Comment